Maximizing Savings: Best Strategies for Different Income Levels

Whether you’re pulling in six figures or navigating a more modest income bracket, saving money remains a universal challenge but also a necessary aspect of financial security. In this detailed guide, we’ll explore practical and effective strategies tailored to different income levels, helping everyone enhance their saving habits irrespective of their earnings. Discover the best ways to optimize your savings plan, address common financial concerns, and set yourself up for long-term financial success.

Understanding Your Financial Standing

Before diving into saving strategies, it’s crucial to fully assess your financial situation. This means examining your income sources, monthly expenses, debt levels, and financial goals. A clear understanding of your cash flow helps in identifying how much money you can realistically set aside each month.

Tracking Your Spending

Budget tracking apps or simple spreadsheets can efficiently monitor where your money goes each month. By categorizing your expenses, you can see potential areas for cost-cutting which directly opens opportunities for increased savings.

Savings Strategies for Low-Income Earners

When your budget is tight, saving money becomes both a priority and a challenge. Here are effective ways to save when funds are limited:

1. Prioritize High-Interest Debt

Paying down debts, particularly those with high interest, is a foundational step. It reduces the amount spent on interest and frees up more funds in the future.

2. Embrace Frugal Living

Adopting a frugal lifestyle by cutting unnecessary expenses and seeking out discounts and deals can make a significant difference.

3. Automated Savings Plans

Setting up an automatic transfer to a savings account can help make saving a consistent habit, no matter how small the amount.

Savings Strategies for Middle-Income Earners

Those in the middle-income bracket often balance between paying bills and saving for the future. Here are strategies to maximize your saving potential:

1. Optimize Your Employee Benefits

Take full advantage of employer-provided benefits such as matching retirement contributions, health savings accounts (HSAs), or flexible spending accounts (FSAs).

2. Tax Planning

Understanding how to efficiently file your taxes can save you a considerable amount annually, which can be redirected into savings or investments.

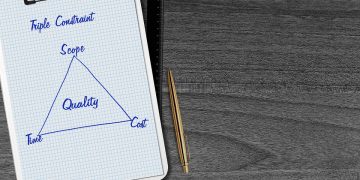

3. Diversify Your Investments

Expand your portfolio beyond basic savings. Consider mutual funds, stocks, or bonds to grow your wealth over time.

Savings Strategies for High-Income Earners

High-income earners have the advantage of investing in more substantial and diverse financial instruments. Here’s how you can maximize your capacity to save:

1. Max Out Retirement Contributions

Utilize your income range to contribute the maximum to your retirement funds, such as 401(k)s and IRAs, to both decrease your taxable income and secure your financial future.

2. Real Estate Investments

Investing in property can not only provide passive income but also serve as a long-term investment due to property appreciation.

3. Luxury Spending Control

Keep tabs on luxury expenditures. While it’s okay to enjoy your earnings, ensuring that these purchases don’t impede your saving goals is crucial.

Common Questions About Saving Money

How much should I save each month?

Financial experts usually recommend saving at least 20% of your monthly income. However, this can vary based on your debts, expenses, and financial objectives.

What should I do if I live paycheck to paycheck?

Focus on creating a budget, reducing unnecessary expenses, and possibly seeking additional sources of income. Saving even a small amount consistently can compound over time to offer financial relief.

Is it worth investing when I have debt?

Typically, if the interest on your debt is higher than what you expect to earn from investments, prioritize paying off the debt. Otherwise, a balanced approach to both can be beneficial.

Conclusion

Maximizing savings is achievable at any income level with the right strategies and mindset. By understanding your finances, applying income-appropriate techniques, and consistently evaluating your financial goals, you can strengthen your savings and secure your financial future effectively.